FAFSA Submission Summary

Review your FAFSA Submission Summary to see eligibility for federal student loans and Pell grant. After your 2026–27 FAFSA application is submitted and processed, you should receive an email with instructions on how to access an online copy of this summary.

Last updated on January 7, 2026 by College Financial Aid Advice.

FAFSA Submission Summary

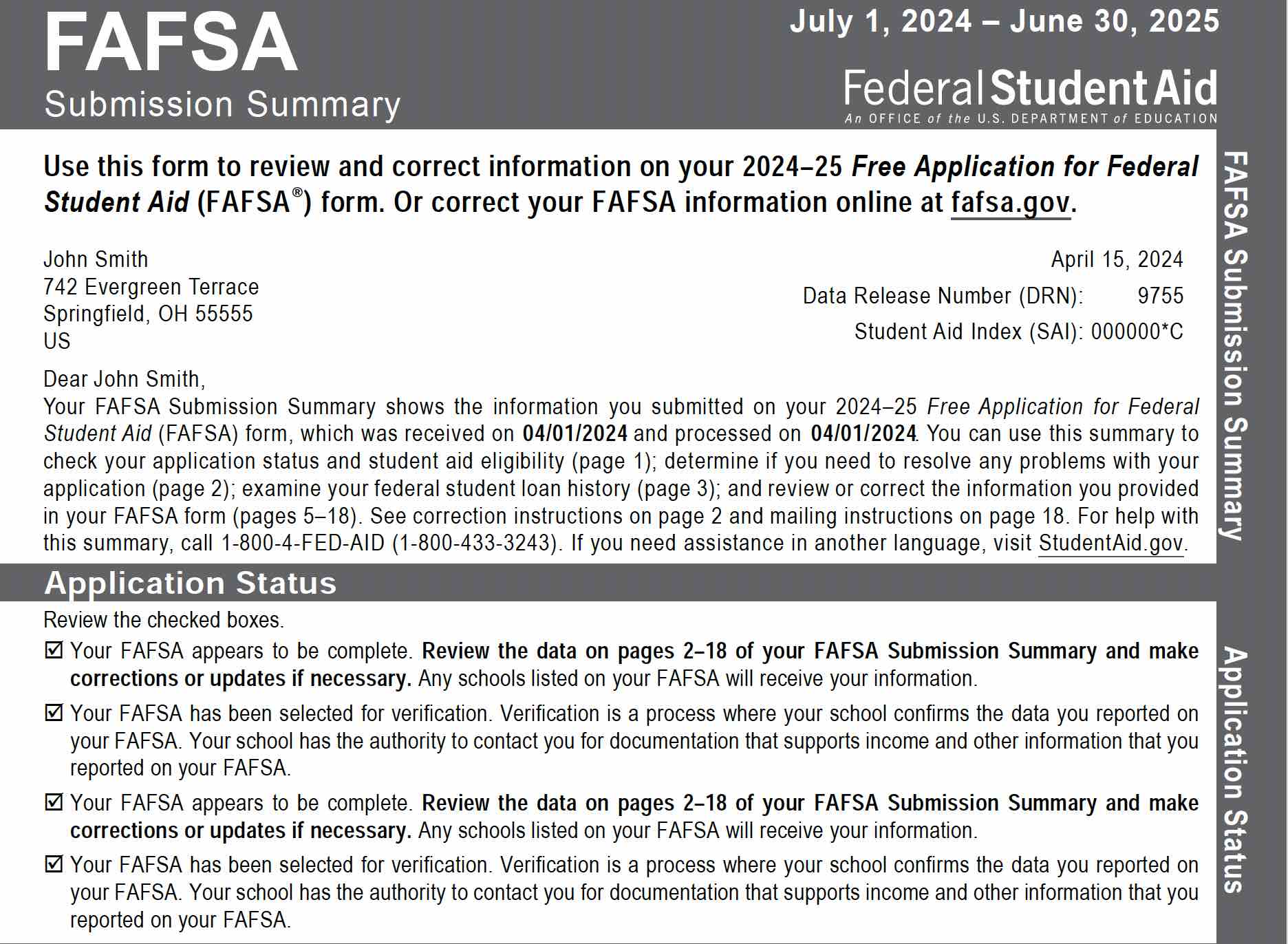

The FAFSA Submission summary is an electronic or paper document that summarizes the information you supplied on your FAFSA application. New starting in 2024, it helps you understand your estimated eligibility for federal student loans and the Pell Grant award. It also includes your your Student Aid Index (SAI), and whether you’ve been selected for verification. The FAFSA Submission Summary replaces the Student Aid Report for the 2026–27 school year.

Receiving Your FAFSA Submission Summary: Most students will receive the FAFSA Submission Summary via email. You can also view it online in your StudentAid.gov account. If for some reason your email is invalid, you will receive the form in the mail. Review and make sure that there are no mistakes (see below).

Keep checking the financial aid website for each college or university you have applied to for additional financial information they may need. Also, check your Spam box periodically in case any emails from the schools you have applied to have been delivered there.

Reviewing Your FAFSA Submission Summary

Eligibility Overview: Includes the date your application was received, date processed, and a four-digit Data Release Number (DRN). You will need the DRN if allow the Federal Student Aid center, or your college to modify anything on your FAFSA. It also includes your estimated federal student aid unless action is required on your part. You will need to provide the requested information to determine your eligibility for federal student aid such as federal student loans or the Pell Grant award. If you’ve been selected for verification, there will be an asterisk by your SAI. Your school will request additional documentation to verify select information.

The FAFSA Submission Summary is critical - it tells you if there is something wrong that will hold up your FAFSA financial aid process. Be sure to check and make it right, or you may not receive any financial aid for college that year!

FAFSA Form Answers: See the answers that you provided.

School Information: See the list of schools who will receive your FAFSA information. It will also show various statistics that may help you determine which schools will be a better financial choice. These include graduation rates, retention rates, transfer rates, loan default rates, median debt upon completion, and average annual cost of attendance.

Next Steps: See next steps (if any) and informational comments.

For more information see studentaid.govFAFSA Correction

Updating

FAFSA Application

If you submit your FAFSA early (which you should do), you occasionally must go back and do a FAFSA correction to update your entries to reflect your actual income and expenses. Another reason for updating your FAFSA application is to report any unusual family circumstances that affect your financial situation such as loss of employment or unexpected high medical expenses.

If you filed your FAFSA application online, it is significantly easier to make FAFSA corrections to your financial data. Starting in 2024-25 application, you will need to agree to automatically retrieve IRS financial information or Federal Tax Information (FTI), even if you did not file federal taxes. This replaces the former IRS Data Retrieval Tool (DRT).

Student Aid Report

What was the Student Aid Report? The SAR report was an important financial aid application confirmation report after you submit your FAFSA. This report listed any issues with your application that must be resolved before you are eligible for financial aid for college.

Note that beginning with the 2024-25 FAFSA application, the Student Aid Report was replaced with the FAFSA Submission Summary.

After your submit your FAFSA application for student financial aid, the student received a Student Aid Report. If your application was complete, you would have a EFC displayed on your Student Aid Report. If your application is incomplete, you would have a list of items that need correction.

Before 2020, if you were a male student, and your name, birth date and social security number did not find a corresponding match in the Selective Service database, you would receive a notice that you are not registered with the Selective Service. The FAFSA no longer requires this.

More FAFSA Information

Dependent or Independent Student

Welcome!

Welcome to College Financial Aid Advice, a website full of information on scholarships and grants, student loans, and other ways to save money at college.

Important Things to Do

Scholarships for 2026 - 2027 - It is never too early or too late to work on your scholarship searches. If you are part of the high school class of 2026, you should work on your scholarship and college search now. See our list of Scholarships for High School Seniors

FAFSA - The official 2026 - 2027 FAFSA is available now. FAFSA.

College Financial Aid Tips

Scholarship Lists An overview of the different types of Scholarship Money for College.

Grants Learn more about grants, the other free money for college.

Need Tuition Help? Reduce the cost of tuition with these college Tuition Assistance Programs.

Tax Credit Claim the American Opportunity Tax Credit.

College Savings Plans Save money for college with these College Savings Plans.

Need a Student Loan? Yes, you qualify for these college Student Loans.

Popular Scholarship Searches

Scholarships for High School Students